by Barbara Rothschild

There are changes going into effect as of January 1st, 2020. The GIT that we partnered with through NYSADA can no longer operate as a trust. That being said, SADA will still handle health insurance for our members.

The biggest change will be that groups over 100 must be experience rated and all businesses under 100 will use a community rated system.

How does this affect our members?

- SADA has a licensed insurance arm, SADA Service Corporation, and we are brokers with many insurance companies. While the changes create a level playing field for all brokers, we have some very strong advantages that others do not.

- We only sell and service our members. Once open enrollment is over, our efforts are geared only for your employees. We do enrollment meetings, assist with inputting insurance information and most importantly, work daily assisting your employees with claims or questions they need answered.

- This enables your office managers one less obligation and puts the onus on the outstanding SADA staff that has a direct relationship with your employees. We take on the burden from your staff and make health insurance much easier to handle.

- Under the new system, rates for under 100 employee groups are determined only by benefit levels. Obviously the higher the deductibles, the lower the rates. You are allowed three or four insurance options. All employee groups over 100 are direct bid based on the census provided to the company. The same holds true…the higher the deductibles the lower the rates.

- The complexity of health insurance requires constant updates and that is where we excel. The most important obligation we have to our members is to see that their employees have the benefit levels they need.

Please contact Denise or Pam if you have questions of concerns. The next two months will be extremely important, and we urge that you talk to us before entering into any agreement for health insurance with another broker. As stated, SADA is dedicated to auto dealers exclusively.

Collectively we bring over 80 years of experience related to the needs of the auto dealers, employees and dealerships in general. Our experience differentiates us from the rest.

SADA DENTAL INSURANCE

In 1986, employees requested that we offer a dental plan as costs kept increasing and they felt a need for this benefit.

Today, we have a dozen participating dental offices and over 700 lives covered. Approximately 65% of the employees and family members covered go to our participating dentists.

That allows them cleaning, x-rays, fillings and minor procedures to be covered in full. There is a small charge for crowns, bridges, etc. Preventative measures are crucial to good health.

While many plans have percentages and flat fees, the SADA plan does not and we work very effectively with employees and local dental offices.

Claims are paid every week and we are always available to assist in seeing that employees are effectively utilizing the plan and getting good dental coverage. If you are not signed up, we urge that you contact our office and we will provide you with all the information to make a sound decision and join the SADA Dental Plan.

TIM FURLONG, OUR CONSULTANT

The SADA Board in June voted to hire Tim Furlong, former NYS DMV Regional Director of Vehicle Safety to be a consultant for the Association. Any dealer with questions or concerns with Inspection or repair shop can reach out to our office and we will work with Tim. He is also developing seminars that will highlight important issues on Inspection and Repair Shop regulations. They should be scheduled this fall. He brings over 30 years of knowledge related to DMV matters as well as being an experienced auto technician. We are thrilled that he will work with this office and assist our members. You MUST call our office in order to have your questions or concerns addressed.

GUIDANCE COUNSELOR LUNCHEON

Last November, BOCES hosted a luncheon for the SADA with area guidance counselors and the results have been very positive. Our service directors committee met with them and due to these efforts, we were invited to area job fairs in high schools. Our goal was to have guidance counselors recognize career opportunities for students in auto tech and collision programs.

On October 22, 2019 we will be hosting our own luncheon at Vito’s and have invited counselors from all area BOCES and school districts. President Rich Burritt will be handling the program along with members of the service directors committee. Patrick Curry a Special Assistant to the Commissioner of Motor Vehicles will join us. We welcome more service directors to join the committee as there are already job fairs scheduled and this is our opportunity to talk to potential future employees. Contact Pam if you would like to join us for the luncheon or get your service director involved with the committee.

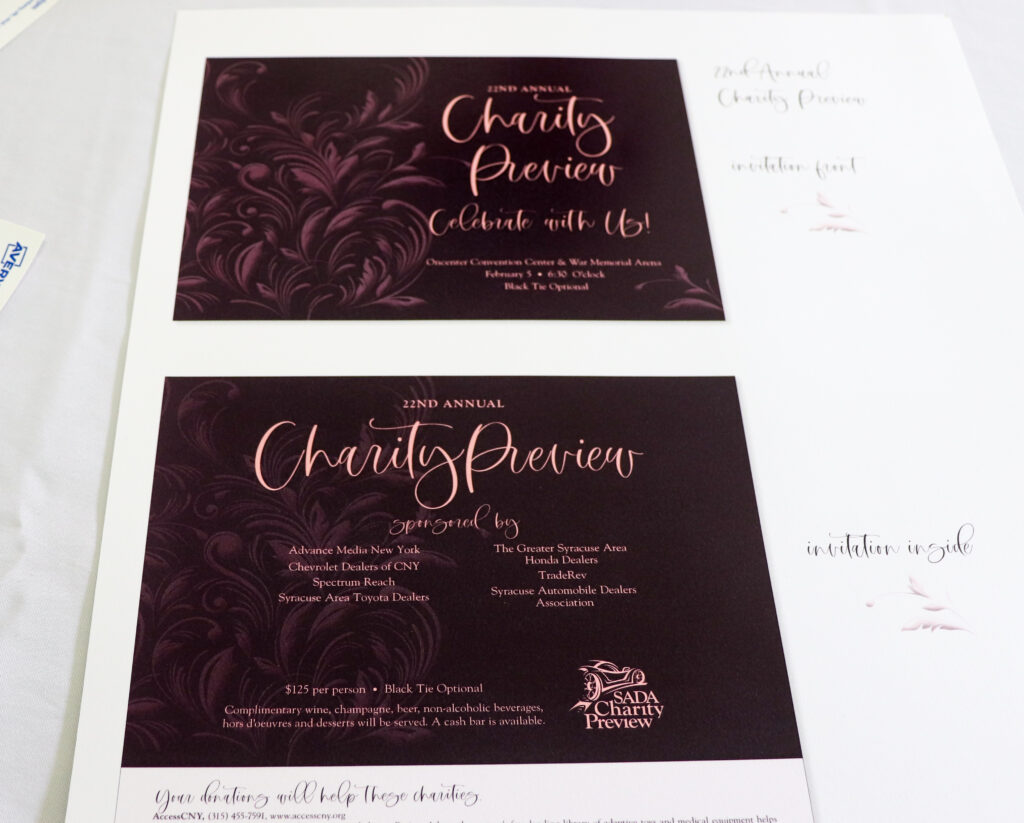

CHARITY PREVIEW KICKOFF

We officially kicked off the 2020 Auto Expo Charity Preview on September 11, 2019. Charity Preview 2020 will have 15 charities involved; we expect ticket sales to exceed 2,000. To date, the Charity Preview committee has raised over $100,000 to pay for the party. With the increased numbers expected to attend, those efforts must continue. With the goal of 100% of the ticket sales being returned to the charities, the committee will need to set a goal of $140,000 in underwriting.

Full details will be forthcoming. It’s an event that has brought the auto dealers in Central New York a very positive image in the community and one that you all can be proud of.

SAVE THE DATE 2020 SYRACUSE AUTO EXPO

Thursday February 6th thru Sunday, February 9th.

2020 Charity Preview

Wednesday, February 5th at 6:30 PM

HAZARDOUS ABATEMENT BOARD GRANT

Every year, we write a Hazardous Abatement Board Grant that provides funding for OSHA training in area dealerships. We have again been approved and starting August 1st, we will offer training in your dealerships at no charge on OSHA compliance subjects. Once we have signed the contract with the state, Pam will put out the information on subjects that will be available. While OSHA training may not be the most popular priority for our members, you need to be reminded that it is extremely important. We maintain all records here including the sign-up sheets to prove that you have been pro-active in OSHA training. Over the years, these files have been invaluable when an employee files a complaint with OSHA or there is an incident in your dealership.

Are you running out or room??? Do you feel like you need a new building just to house all your deal jackets, RO’s and other key paperwork? Have you heard about DealerDOCX?

DealerDOCX specializes in secure end-to-end Cloud-based document management solutions and scanning as a service for the Automotive industry. We take the boxes, filing cabinets, and storage rooms of deal jackets, ROs, and other key paperwork that you’re required to hold onto, and move every page to the Cloud. With our main scan center, we support our clients across the Northeast, New England, Mid-Atlantic, Southeast, Midwest, and beyond, our goal is to save your dealership time, space, and money through high-performance electronic document management.

Contact Pam at SADA, 315-474-1041, to learn more and schedule an in-office demonstration of just how beneficial, quick, easy and inexpensive this service can be.

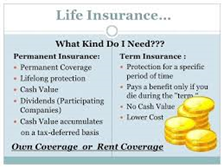

Have we got great news for you and your employees! As a member of SADA you can apply for personal insurance products from The Paul Revere Life Insurance Company!

These benefits can enhance your current benefits portfolio and can be customized to fit your individual needs.

Also:

- Coverages are available for employees and their family, with most products.

- You will enjoy the convenience of premium payment through payroll deduction.

- You will have the ability to take most coverages with them if they change jobs or retire.

Accident Insurance –helps offset the direct and indirect expenses such as deductibles, co-payments and other costs not covered by traditional health plans.

Specified Disease for Cancer/– helps offset the out-of-pocket medical and indirect nonmedical expenses related to critical illness that most medical plans may not cover.

Short term Disability Insurance (Paycheck Protection) – helps offset financial losses that result when employees are unable to work.

Term Life Insurance/Whole Life

Helps provide financial security for family members and allows employees to tailor their protection to help meet their individual needs.

Contact Pam and Denise, 315-474-1041 to schedule QUARTERLY enrollments for all your NEW employees.